Generate Form E and CP8D txt file via the PayrollPanda system. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara.

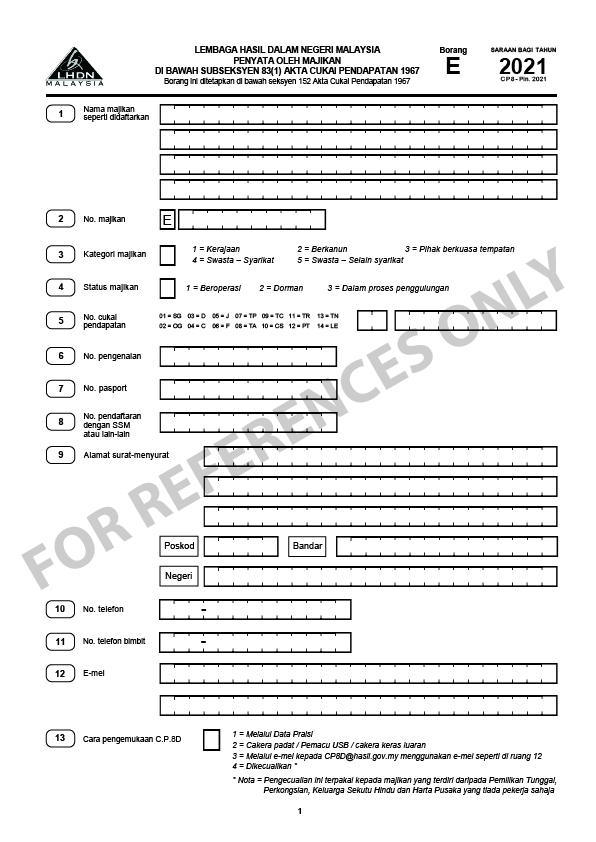

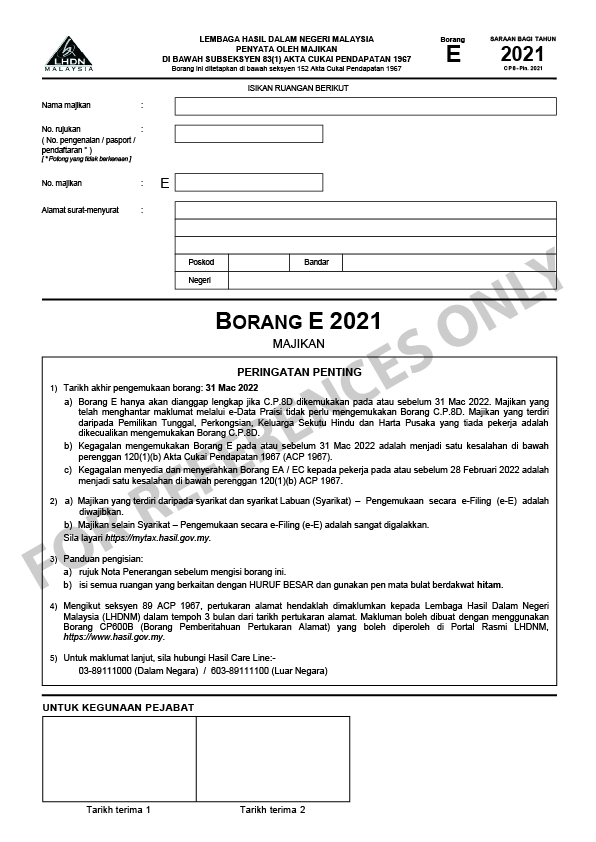

Every company needs to submit Form E according to the Income Tax Act 1967 Akta 53.

. Login to the PayrollPanda system go to Yearly Forms Select Form E Download the CP8D txt file and form E pdf file. Easy Fast Secure. How to submit Form E via e-Filing.

2019 B LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS. Select the Year Assessment you will be filing for. Please be reminded to check the forms as it is the employers responsibility to provide accurate information to the.

Benefit of submit borang be to lhdn. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. For further information please contact Hasil Care Line-Hotline.

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. Dasar Privasi Dasar Keselamatan.

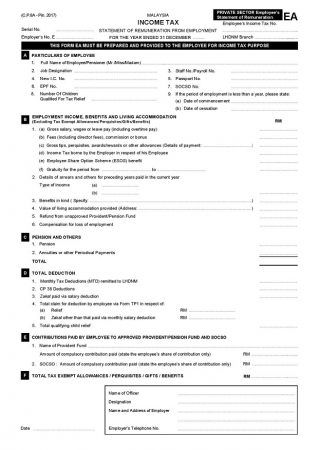

Employers who have e-Data Praisi need not complete and furnish CP8D. Do Your 2021 2020 any past year return online Past Tax Free to Try. B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967.

7 The use of e-Filing e-B is encouraged. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021.

Please access via httpsezhasilgovmy. ðMenghantar surat makluman ke Cawangan di mana fail Majikan berada untuk tindakan supaya Borang E tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula. Understanding Lhdn Form Ea Form E And Form Cp8d.

03-89111000 603-89111100 Overseas 2019 YEAR OF ASSESSMENTForm Amend. ðBorang E yang diterima itu perlu dilengkapkan dan ditandatangani. Posted in borang b.

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. In addition every employer shall for each calendar year prepare and render to. Every employer shall for each year furnish to the Director General a.

Select form type e-E and input your Income Tax No. Refund will be notified by e-mail. EA CP8C must be prepared and rendered to the employees on or before 28 February 2021 to enable them to complete and submit their respective Return Form within the stipulated period.

Yang ni admin anggap korang tahu. Easy Fast Secure. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

State or Local Law Enforcement 0389 07172012 Form 433-A. ðIsikan 0 di Bahagian A dan Bahagian B Borang E 2010. A Form E will only be considered complete if CP8D is submitted on or before 31 March 2020.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Due Day Extended For Personal Tax Submission 15 May 2013 E Filing

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Submit Income Tax 2019 Through E Filing Lhdn Otosection

Form E 2018 What You Need To Know Kk Ho Co

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Use Lhdn E Filing Platform To File Borang E To Lhdn Clpc Group

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang E Archives Tax Updates Budget Business News

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

![]()

How To Submit Income Tax 2019 Through E Filing Lhdn Otosection

How To Submit Form E With Swingvy Malaysia Youtube

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News